Solutions

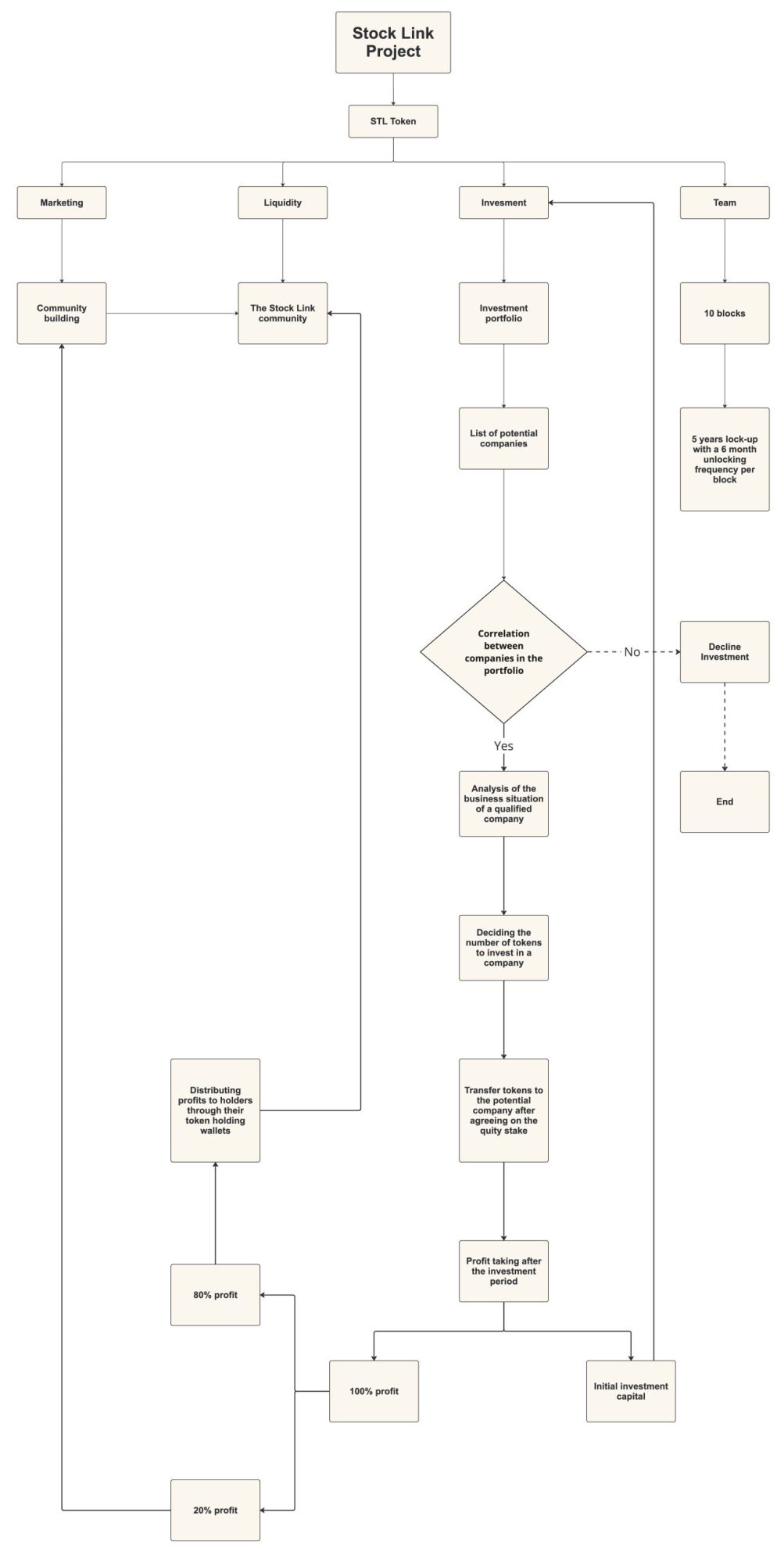

Stock Link's Crypto to Stock (C2S) model is a revolutionary investment solution that directly addresses the Bitcoin dependency problem that has caused much volatility and risk to the cryptocurrency market. Instead of relying solely on token price fluctuations, C2S converts STL tokens into actual shares in potential companies. This not only diversifies the investment portfolio and reduces risk but also opens up opportunities to generate sustainable profits through sharing dividends from the profits of these companies.

With C2S, investors are no longer passive in the face of unpredictable fluctuations in the crypto market. Instead, they become actual shareholders in businesses, participating in the growth and development of these companies. This brings stability and long-term growth potential to the portfolio, not just dependent on token price fluctuations.

C2S also takes advantage of the 24/7 liquidity of the cryptocurrency market, making it easy for investors to buy, sell, and convert STL tokens into shares or vice versa at any time. This solves the liquidity problem often encountered in the traditional stock market, where trading only takes place during limited business hours.

Furthermore, sharing dividends from the profits of investment companies gives investors a stable and passive income source. Instead of just waiting for the token price to increase, investors can benefit from the actual business activities of the companies, creating a steady and sustainable cash flow.

In short, Stock Link's C2S is an advanced investment model that combines the advantages of both the cryptocurrency market and the stock market. By reducing risk, increasing liquidity, and creating a stable income source, C2S offers investors a comprehensive investment solution with high-profit potential.

However, Stock Link does not underestimate the potential challenges in this journey. We are aware of the legal barriers that may arise when combining the cryptocurrency and stock markets, and we are committed to working closely with regulators to ensure full compliance with the laws.

Convincing companies to accept investments in STL tokens is also a challenge, but we believe that with the growth potential and superior benefits that the C2S model brings, we will gradually build trust and cooperation with strategic partners.

Investment risk is inevitable, but we have built a rigorous due diligence and risk management process based on the experience and expertise of our leading financial analysis team. We are committed to information transparency and sharing details about investments so that investors can make informed decisions.

Although C2S helps reduce dependence on Bitcoin, we also anticipate fluctuations that may occur in the cryptocurrency market in general. Therefore, we always closely monitor the market and have preventive measures in place to protect the interests of investors.

With careful preparation, a clear strategy, and a professional team, Stock Link is confident in overcoming these challenges and making the C2S model a reality, bringing sustainable value to investors and contributing to developing both the cryptocurrency and stock markets.

The C2S (Crypto to Stock) Model